Introduction

For freelancers, managing finances can be challenging due to irregular income, fluctuating expenses, and tax obligations. Fortunately, there are numerous budgeting apps available that cater specifically to the needs of freelancers, offering features such as income tracking, expense management, invoicing, and tax calculations. In this guide, we’ll explore the top 5 budgeting apps for freelancers that can help streamline financial management and improve overall financial health.

Top 5 Budgeting Apps for Freelancers

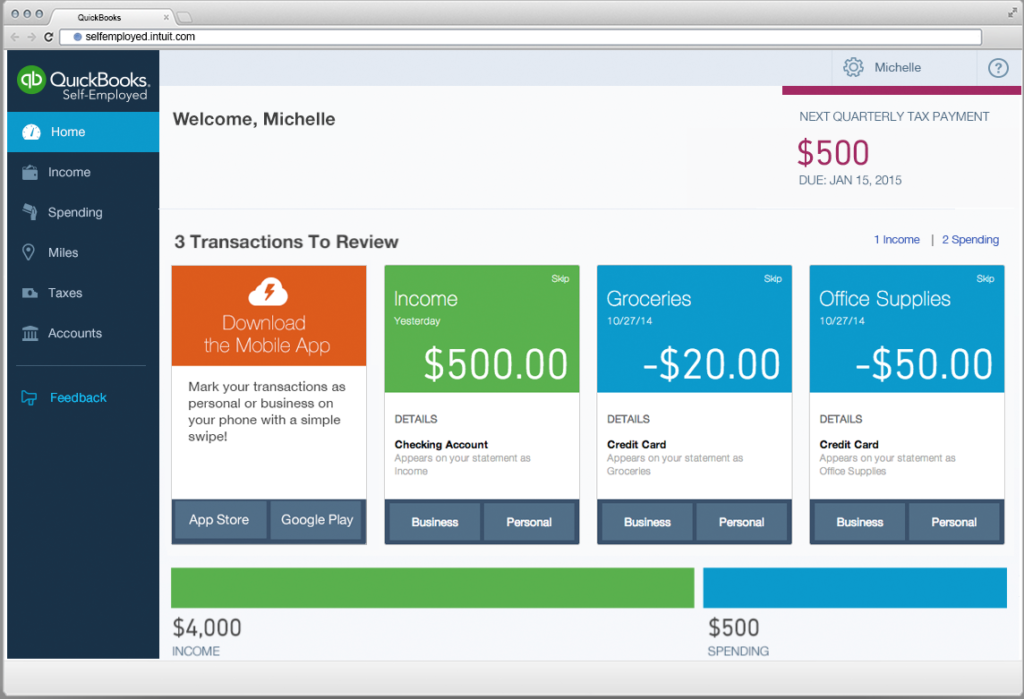

1. QuickBooks Self-Employed

QuickBooks Self-Employed is a comprehensive accounting and bookkeeping software designed specifically for freelancers and independent contractors. The app allows freelancers to track income and expenses, separate business and personal transactions, and automatically categorize transactions for tax purposes. It also offers features such as invoicing, mileage tracking, and quarterly tax estimates, making it an all-in-one solution for freelancer finances.

2. FreshBooks

FreshBooks is another popular accounting software that caters to freelancers and small business owners. The app offers a range of features, including invoicing, expense tracking, time tracking, and project management. Freelancers can easily create professional invoices, track billable hours, and manage expenses on the go. FreshBooks also integrates with popular payment processors and accounting software, making it easy to streamline financial workflows.

3. Wave

Wave is a free accounting and invoicing software designed for freelancers, small businesses, and entrepreneurs. The app offers essential features such as income and expense tracking, invoicing, and receipt scanning. Freelancers can create customized invoices, accept online payments, and track outstanding invoices with ease. Wave also offers additional services such as payroll processing and credit card processing for a fee, making it a versatile option for freelancer finances.

4. HoneyBook

HoneyBook is a business management platform tailored for creative freelancers, including photographers, designers, and event planners. The app offers features such as client management, project tracking, invoicing, and payment processing. Freelancers can create branded proposals and contracts, send invoices and contracts for e-signature, and track payments in real-time. HoneyBook also provides insights into project profitability and client communication, helping freelancers stay organized and efficient.

5. PocketGuard

PocketGuard is a personal finance app that helps freelancers track their income, expenses, and savings goals in one place. The app connects to bank accounts, credit cards, and investment accounts to provide a comprehensive overview of financial transactions and balances. Freelancers can set budgeting goals, track spending by category, and receive alerts for upcoming bills and fees. PocketGuard also offers insights and recommendations to help freelancers optimize their finances and achieve their financial goals.

Budgeting Apps for Freelancers: FAQs

Are budgeting apps safe to use?

Budgeting apps use encryption and other security measures to protect users’ financial information. However, it’s essential to choose reputable apps from trusted providers and follow best practices for online security, such as using strong passwords and enabling two-factor authentication.

Can budgeting apps help with tax deductions for freelancers?

Yes, many budgeting apps offer features to help freelancers track deductible expenses and calculate tax deductions. These apps can categorize expenses, generate expense reports, and provide tax estimates to help freelancers maximize deductions and minimize tax liability.

Do budgeting apps sync with accounting software?

Yes, many budgeting apps integrate with popular accounting software such as QuickBooks, FreshBooks, and Xero. Integration allows freelancers to streamline financial workflows by automatically syncing transactions, invoices, and other financial data between the budgeting app and accounting software.

Can budgeting apps help freelancers with invoicing and payment processing?

Yes, many budgeting apps offer features for creating professional invoices, tracking billable hours, and accepting online payments from clients. These features can help freelancers streamline invoicing and payment processing, improve cash flow, and reduce administrative overhead.

Are budgeting apps suitable for managing business finances as well?

Yes, many budgeting apps are designed to accommodate both personal and business finances, making them suitable for freelancers and small business owners. These apps offer features such as income and expense tracking, invoicing, project management, and tax calculations to help manage all aspects of business finances.

Conclusion

Choosing the right budgeting app is essential for freelancers to effectively manage their finances, track income and expenses, and stay organized throughout the year. Whether you’re looking for basic budgeting features or comprehensive accounting tools, there’s a budgeting app available to suit your needs. By leveraging the features of these top 5 budgeting apps for freelancers, you can take control of your finances, streamline financial workflows, and focus on growing your freelance business.