Introduction

Investing during times of economic uncertainty can be challenging, as market volatility and unpredictable events can create uncertainty and anxiety for investors. However, it’s essential to remember that uncertainty also brings opportunities for savvy investors who are willing to stay disciplined and focused on their long-term financial goals. In this guide, we’ll explore the top 5 investment strategies to navigate economic uncertainty successfully and position yourself for stability and growth.

Top 5 Investment Strategies During Economic Uncertainty

1. Diversification Across Asset Classes

Diversification is a fundamental investment strategy that involves spreading your investments across different asset classes, such as stocks, bonds, real estate, and commodities. By diversifying your portfolio, you can reduce your overall risk exposure and minimize the impact of volatility in any single asset class. During times of economic uncertainty, diversification becomes even more critical as it helps protect your portfolio from significant losses while still allowing you to capture potential gains from different sectors and industries.

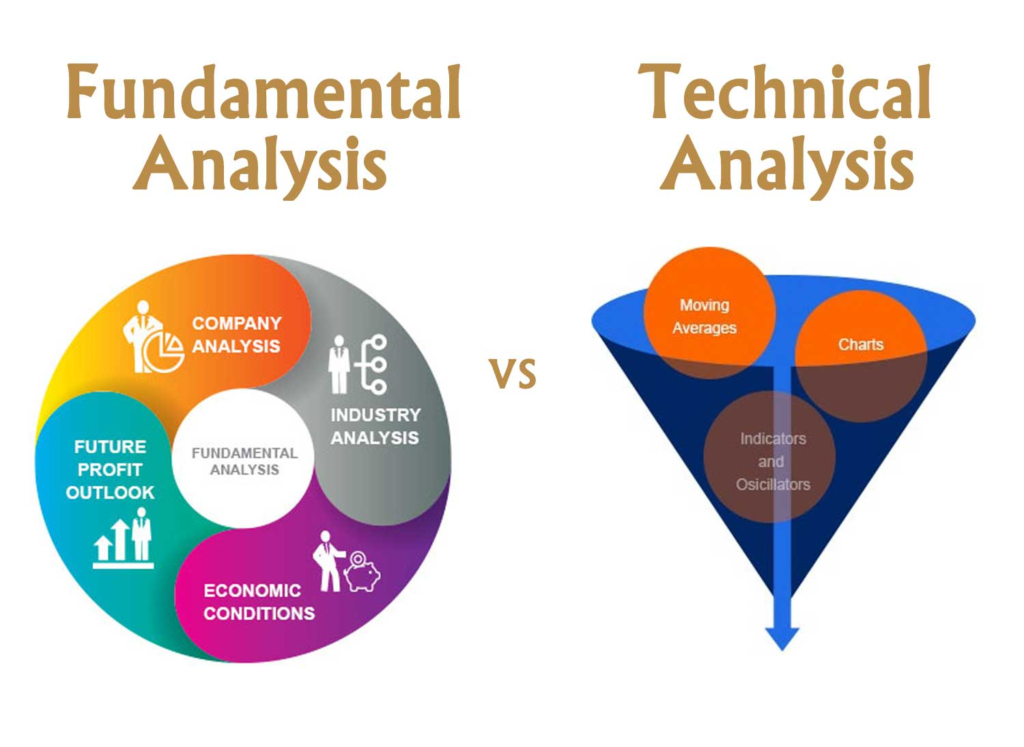

2. Focus on Quality and Fundamental Analysis

During periods of economic uncertainty, it’s essential to focus on quality investments with strong fundamentals and reliable cash flows. Conduct thorough fundamental analysis to identify companies with solid balance sheets, sustainable business models, and competitive advantages. Look for companies with consistent earnings growth, low debt levels, and strong management teams that can navigate challenging economic conditions effectively. By focusing on quality investments, you can minimize risk and position your portfolio for long-term growth.

3. Maintain a Long-Term Perspective

One of the most critical investment strategies during economic uncertainty is to maintain a long-term perspective and avoid making impulsive decisions based on short-term market fluctuations. Remember that market volatility is a normal part of investing, and trying to time the market can be challenging and counterproductive. Instead, focus on your long-term financial goals, stay disciplined with your investment strategy, and avoid reacting emotionally to market ups and downs. Over the long term, staying invested and sticking to your plan is often the most reliable path to investment success.

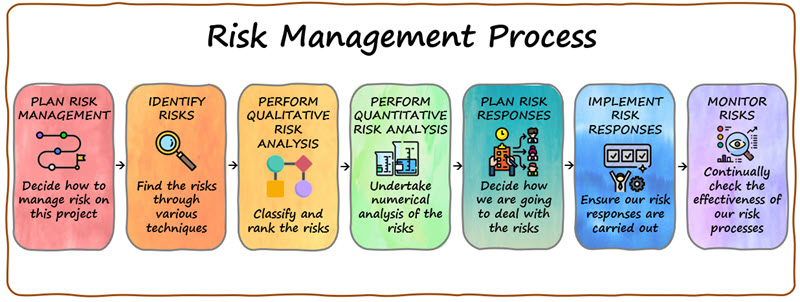

4. Monitor and Manage Risk Effectively

Risk management is crucial during times of economic uncertainty, as unexpected events can have a significant impact on investment portfolios. Regularly monitor your portfolio for changes in risk factors, such as volatility, correlation, and liquidity, and adjust your asset allocation and investment strategy accordingly. Consider using risk management tools such as stop-loss orders, asset allocation rebalancing, and hedging strategies to protect your portfolio from downside risk while still allowing for potential upside gains.

5. Stay Informed and Adaptive

Finally, staying informed and adaptive is essential for navigating economic uncertainty successfully. Stay updated on economic indicators, market trends, and geopolitical developments that may impact your investments. Be willing to adapt your investment strategy as new information becomes available and market conditions change. Consider seeking advice from trusted financial advisors or investment professionals who can provide objective guidance and help you make informed decisions based on your individual financial situation and goals.

Investment Strategies During Economic Uncertainty: FAQs

How can I assess my risk tolerance during economic uncertainty? Assessing your risk tolerance involves understanding your financial goals, investment time horizon, and ability to withstand market fluctuations. Consider factors such as your age, income, expenses, debt levels, and overall financial situation when evaluating your risk tolerance. Be honest with yourself about your comfort level with volatility and adjust your investment strategy accordingly.

What are some alternative investments to consider during economic uncertainty?

During economic uncertainty, investors may consider alternative investments such as gold, real estate, commodities, and inflation-protected securities as potential hedges against market volatility. These investments can provide diversification benefits and help protect portfolios from downside risk during turbulent times.

Should I make changes to my investment portfolio during economic uncertainty?

Making changes to your investment portfolio during economic uncertainty should be approached with caution. While it may be tempting to react to short-term market fluctuations, it’s essential to stick to your long-term investment plan and avoid making impulsive decisions. Consider consulting with a financial advisor or investment professional before making any significant changes to your portfolio.

What are some signs that economic uncertainty is easing?

Signs that economic uncertainty may be easing include improving economic indicators such as GDP growth, unemployment rates, consumer spending, and business confidence. Additionally, positive developments in geopolitical events, monetary policy, and fiscal stimulus measures can help alleviate uncertainty and restore investor confidence in the market.

How can I take advantage of investment opportunities during economic uncertainty?

Taking advantage of investment opportunities during economic uncertainty requires patience, discipline, and a willingness to take calculated risks. Look for quality investments trading at attractive valuations, focus on sectors and industries with long-term growth potential, and consider dollar-cost averaging to gradually invest funds over time. By staying informed, adaptive, and disciplined, you can capitalize on investment opportunities while managing risk effectively.

Conclusion

Navigating economic uncertainty requires a disciplined approach, sound investment strategies, and a long-term perspective. By diversifying across asset classes, focusing on quality investments, maintaining a long-term perspective, managing risk effectively, and staying informed and adaptive, investors can position themselves for stability and growth even in turbulent times. Remember that uncertainty brings opportunities for those who remain disciplined and focused on their long-term financial goals.